Trump's Comments Weaken Dollar; Micron Appears Overbought

Memory Supercycle

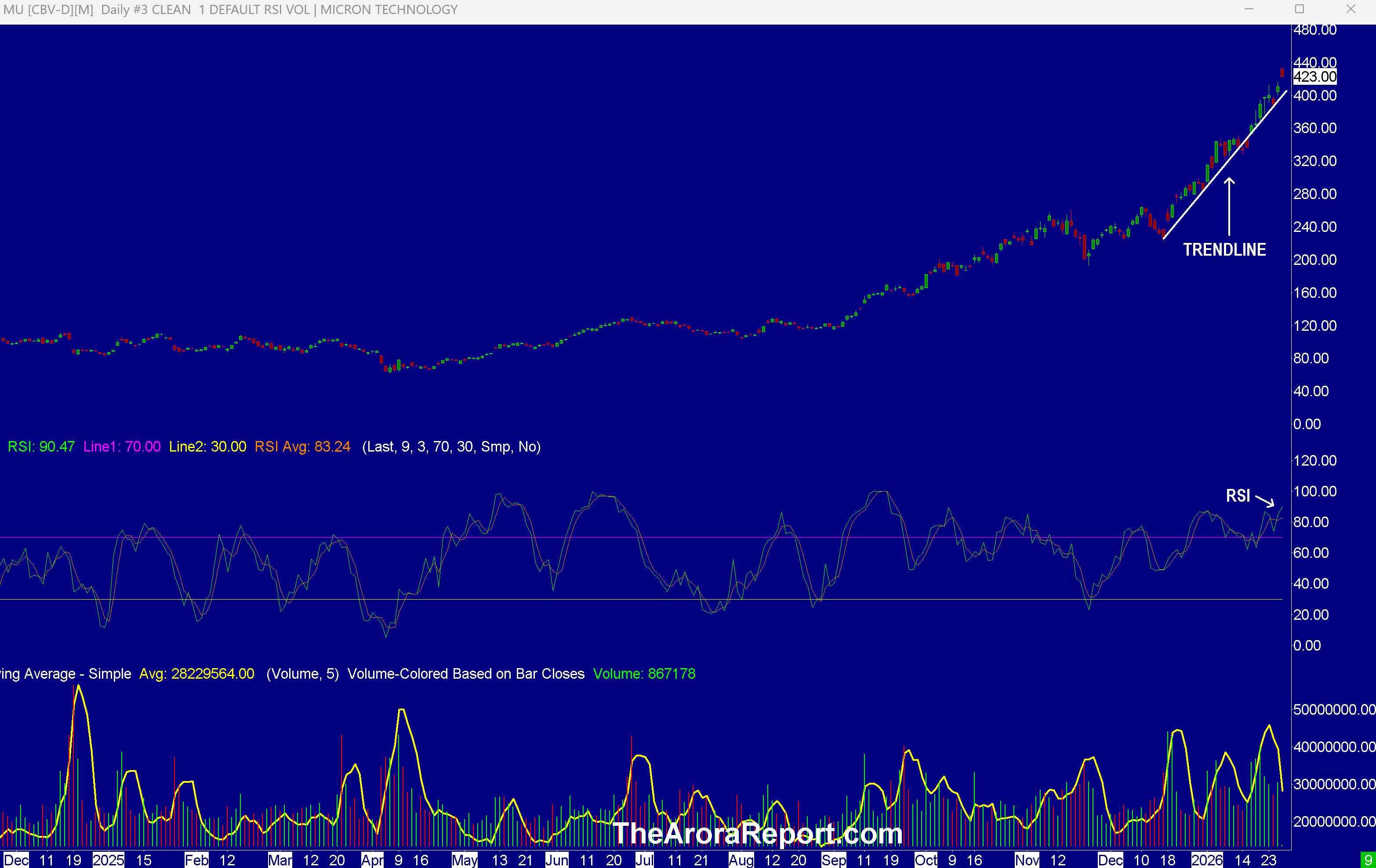

Please click here for a chart of Micron Technology Inc (NASDAQ:MU).

Note the following:

- The trendline on the chart shows MU stock has gone parabolic on AI demand for high bandwidth memory.

- Disk drive maker Seagate Technology Holdings PLC (NASDAQ:STX) reported earnings better than consensus and whisper numbers. Comments from Seagate indicate the storage and memory supercycle driven by AI has further to go.

- The chart shows MU stock is gapping up on comments by Seagate.

- Earnings from NAND memory maker SanDisk Corp (NASDAQ:SNDK) and disk drive maker Western Digital Corp (NASDAQ:WDC) are ahead. They will provide further clarity on the memory and storage demand driven by AI.

- RSI on the chart shows MU stock is very overbought. As full disclosure, we gave a signal yesterday to take partial profits on MU stock. There is a high probability of a short squeeze in MU stock. If a short squeeze occurs, it can drive MU stock over $500. Conversely, if there is no short squeeze and earnings from WDC or SNDK disappoint, MU stock is vulnerable to a pullback because it is so overbought.

- Stocks in South Korea are jumping again. Now KOSPI has a gain of about 29% in January alone. The gains in KOSPI are driven by two memory makers Samsung Electronics Co Ltd (OTC:SSNLF) and SK Hynix (HXSCL). As full disclosure, on April 9, 2025, we gave a signal to buy Ishares Msci South Korea ETF (NYSE:EWY) as one of the top countries to consider. At the time of the signal, EWY was trading at $48.91. EWY is trading at $125.38 as of this writing in the premarket. This illustrates the importance of paying attention to markets outside of the U.S. South Korea's Trade Minister Yeo Han-koo is set to be in Washington DC to talk with Trade Representative Jamieson Greer. If President Trump backs off from his threat to raise tariffs on Korea goods from 15% to 25%, Korean stocks can take another leg higher. South Korea was the best performing stock market in Asia in 2025.

- Texas Instruments Inc (NASDAQ:TXN) has accomplished something it has not done in 16 years – it is projecting Q1 revenue higher than Q4 revenue. Texas Instruments is mostly a supplier of analog chips. Recovery in analog chips for industrial and automotive applications is still moderate. TXN stock is benefiting from orders from AI data centers. In our analysis, in the long run, TXN will be a major beneficiary of humanoid robots. As full disclosure, TXN is in our portfolio. The stock is jumping up about 8% as of this writing in the premarket.

- Yesterday, the dollar fell the most in a single day since the April 2025 tariff related drop. The trigger was President Trump's comment that he was not concerned about falling dollar. As the dollar fell, it brought in significant buying in stocks, gold, silver, and oil. In our analysis, all of this is great in the short term but is detrimental to the U.S. in the long run.

- Consumer Confidence fell to 84.5 in January vs. 90.0 consensus. In our analysis, the steep drop in confidence is coming from working class people who do not own stocks or houses. Here is a key question for prudent investors: How long is this K-shaped economy sustainable?

- The Fed rate decision will be announced today at 2pm ET, followed by Fed Chair Powell's press conference at 2:30pm ET. In our analysis, there is an 85% probability of no rate change.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are positive in Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc Class C (NASDAQ:GOOG), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are negative in Apple Inc (NASDAQ:AAPL).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (NYSE:SPY) and positive in Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (NYSE:USO).

Oil

API crude inventories came at a draw of 0.247M barrels vs. a consensus of a build of 1.45M barrels.

Bitcoin

Bitcoin (CRYPTO: BTC) is seeing buying.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasMarket Summary Opinion